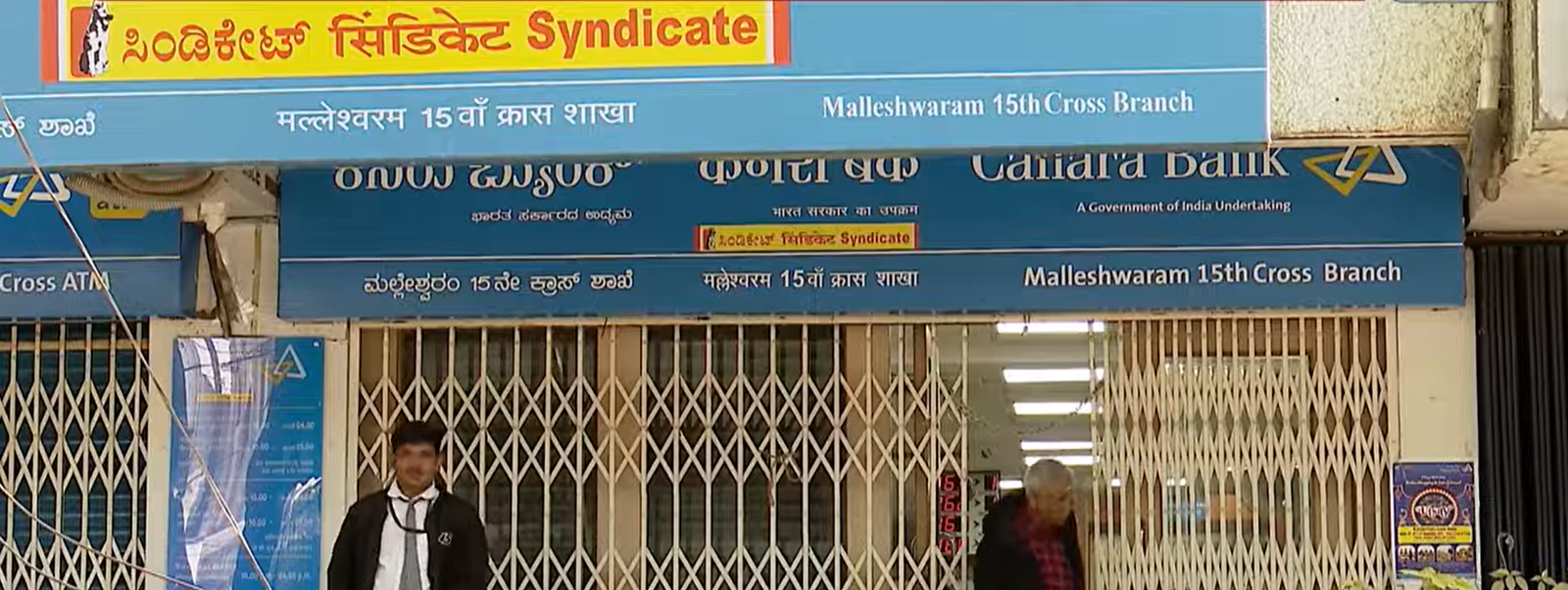

Bengaluru: In a shocking breach of trust, a senior manager of Canara Bank’s Malleshwaram branch has allegedly orchestrated a massive ₹3.11 crore gold loan scam, cheating more than 21 customers, most of them elderly pensioners, before going absconding.

According to preliminary investigations, the accused manager, identified as Raghu, fraudulently availed gold loans in the names of customers without their knowledge or consent—even though no gold was pledged. The scam came to light when customers began receiving loan repayment alerts and notices for accounts they had never applied for.

Victims allege that the manager exploited their trust by collecting OTPs, signatures, and blank cheques, under various pretexts. Several customers told police that they shared OTPs believing they were routine banking formalities.

“I gave the OTP because the manager asked for it. Later I realised ₹18 lakh had been withdrawn in my mother’s name. We never pledged any gold,” said one shocked family member.

The fraud surfaced during a bank audit and after loan instalments went unpaid, triggering internal scrutiny. As soon as the irregularities were detected, the accused manager reportedly disappeared, prompting a police manhunt.

Bank officials have begun collecting documents and statements from affected customers to assess the full scale of the fraud. Police sources say the investigation is focusing on how loans were sanctioned without collateral and whether internal lapses or collusion were involved.

The incident has left customers questioning the very foundation of banking trust.

“If even a bank manager can cheat us, who can we trust?” asked an elderly pensioner affected by the scam.

A formal complaint has been registered, and police teams are actively tracking the absconding accused. Further details are expected as the investigation progresses.