Bengaluru: In a major technology-driven enforcement action, the Enforcement Wing (South Zone) of the Commercial Taxes Department, Government of Karnataka, has uncovered and dismantled a large interstate fake invoicing cartel involving transactions worth ₹1,464 crore, spanning Karnataka and Tamil Nadu. The racket led to the wrongful availment and circulation of Input Tax Credit (ITC) amounting to approximately ₹355 crore, without any actual movement of goods.

The operation was carried out under the leadership of Vipul Bansal, IAS, Commissioner, Commercial Taxes Department, Karnataka, and supervised at the zonal level by Kanishka Sharma, IAS, Additional Commissioner, Enforcement (South Zone).

According to officials, the cartel primarily dealt in cement, iron & steel and other construction materials, generating fraudulent inward and outward GST supplies through a complex web of shell entities. The detection was enabled through advanced GST analytics, including the department’s in-house Non-Genuine Taxpayer (NGTP) module and IP address trail analysis from the GST back-office system, which flagged abnormal invoicing patterns and circular ITC flows.

Forged Registrations and Shell Firms

Investigations revealed that multiple GST registrations were fraudulently obtained using forged stamp papers procured online, fabricated rental agreements, fake landlord and tenant signatures, false tax-paid receipts and forged notarial attestations. These registrations were then used to float shell firms that issued and circulated fake invoices while projecting a façade of legitimate business operations.

After availing and passing on large amounts of ITC, many entities voluntarily cancelled their GST registrations, a tactic now identified as a new modus operandi to erase audit trails and evade scrutiny. The Enforcement Wing (South Zone) is examining system-level safeguards to prevent misuse of registration cancellation for tax evasion.

Coordinated Raids Across Two States

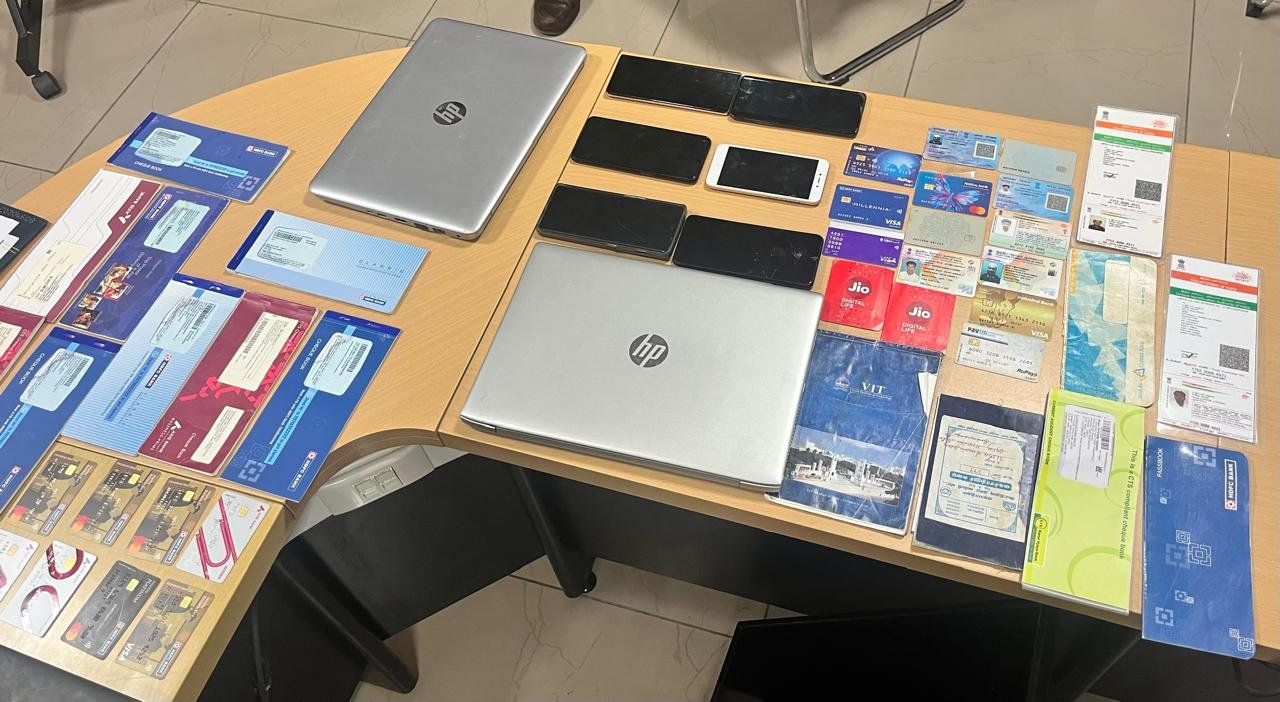

Simultaneous search and seizure operations were conducted in Bengaluru, Chennai, Vellore and Pernampattu, resulting in the seizure of 24 mobile phones, 51 SIM cards, two pen drives, multiple bank statements and rubber stamps of various business entities. Officials said the seized material is expected to yield further digital and financial evidence on the scale and structure of the cartel.

Four Arrested in First-of-Its-Kind Interstate Action

In a first-of-its-kind coordinated interstate enforcement operation, four key accused were arrested with the active cooperation of the Commercial Taxes Department, Government of Tamil Nadu.

Two brothers from Tamil Nadu — Irbaz Ahmed and Nafiz Ahmed — were arrested from Pernampattu for floating fake firms such as Trion Traders, Wonder Traders, Royal Traders and Galaxy Enterprises.

Similarly, Eddala Pratap and Revati, who operated shell entities including Power Steel and Cement, P.R. Construction, S.V. Traders and S.R.S. Cement Steel Traders, were arrested from Bengaluru.

All four accused were produced before the Special Court for Economic Offences, Bengaluru, which remanded them to 14 days of judicial custody.

Commitment to GST Integrity

The Enforcement Wing (South Zone) placed on record its appreciation for the seamless coordination extended by Tamil Nadu Commercial Tax authorities, which was crucial to the success of the operation.

Reiterating its stand, the department said it remains committed to technology-enabled, intelligence-driven and legally robust enforcement to dismantle Non-Genuine Taxpayer (NGTP) networks, safeguard government revenue and uphold the integrity of the GST regime.