GST Council clears PM Modi’s next-generation reforms — relief for medicines, insurance, food items, and household goods, while luxury and harmful products face steep tax.

New Delhi: The Modi government has approved next-generation GST reforms, first announced by Prime Minister Narendra Modi on August 15. The reforms aim to give major relief to the common man, farmers, workers, and small traders, while keeping heavy taxes on pan masala, gutkha, and tobacco products.

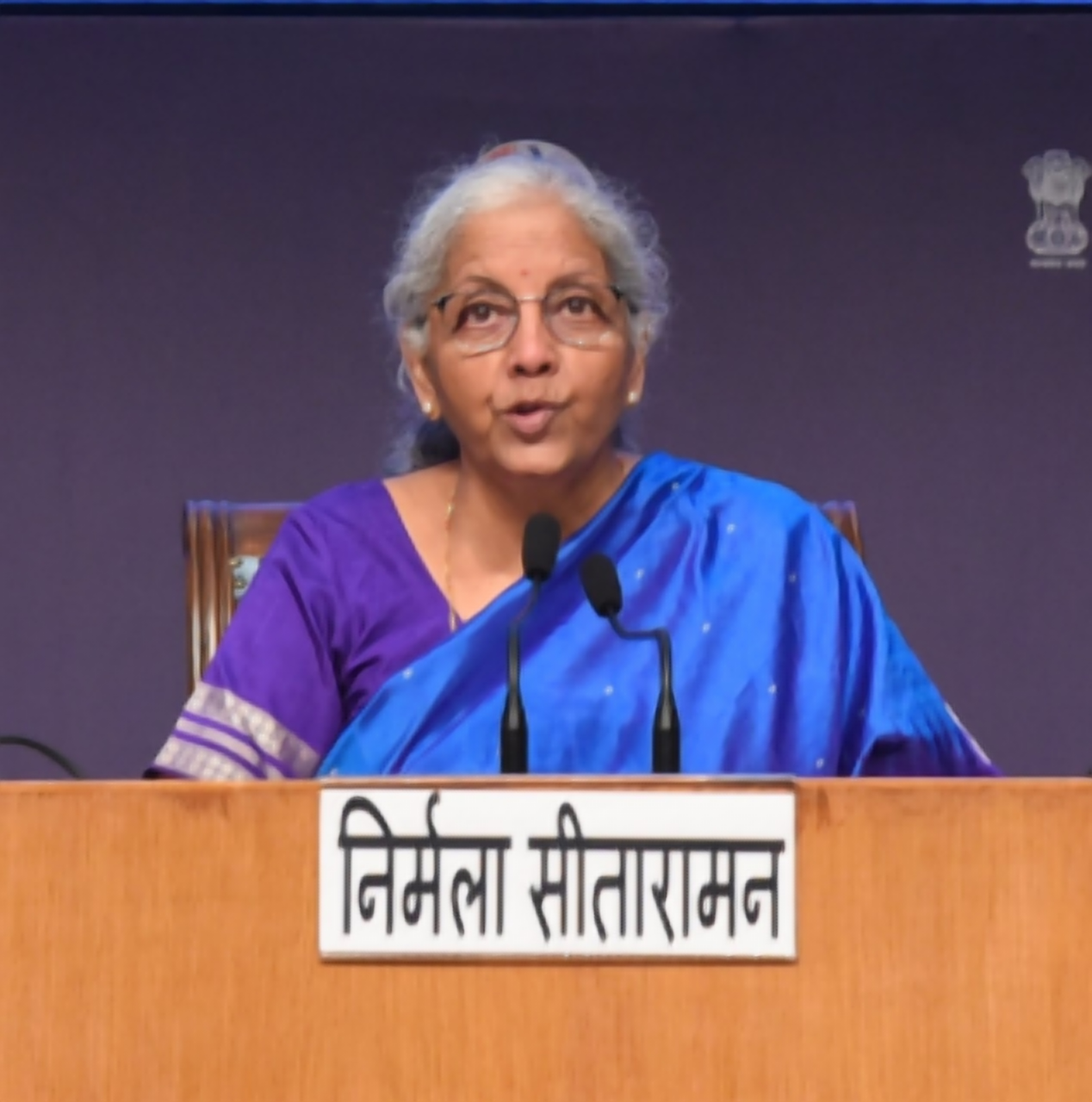

Importantly, these changes will come into effect from September 22, the first day of Navratri. Finance Minister Nirmala Sitharaman announced this during a late-night media briefing in New Delhi.

Relief for the Common Man

- Healthcare Cheaper: 33 lifesaving medicines and 3 critical drugs now GST-free; others reduced to 5%. Health and life insurance policies also GST-exempt.

- Daily Essentials: Milk, paneer, roti, paratha, namkeens, noodles, coffee, chocolates now at 0% or 5% GST.

- Packaged Water: 20-litre water cans reduced from 12% to 5% GST.

- Household Goods: Soap, shampoo, toothpaste, oil, bicycles, kitchenware at 5% GST.

- Farmers & Workers: Tractors, farm machinery, handicrafts, leather, marble at 5% GST.

- Vehicles & Housing: Small cars, bikes, TVs, ACs, and cement down to 18% GST.

Strict on Harmful Products

- Pan masala, gutkha, cigarettes, and tobacco will continue to attract a 40% demerit tax.

- The government said this is aimed at discouraging harmful consumption and safeguarding public health.