Bengaluru, January 2: IT major Infosys Limited has informed stock exchanges that it has received a GST penalty demand of ₹40.72 lakh from the Deputy Commissioner of Commercial Taxes, relating to an alleged mismatch in credit notes reported in GSTR-1 and GSTR-9 for the financial year 2018-19.

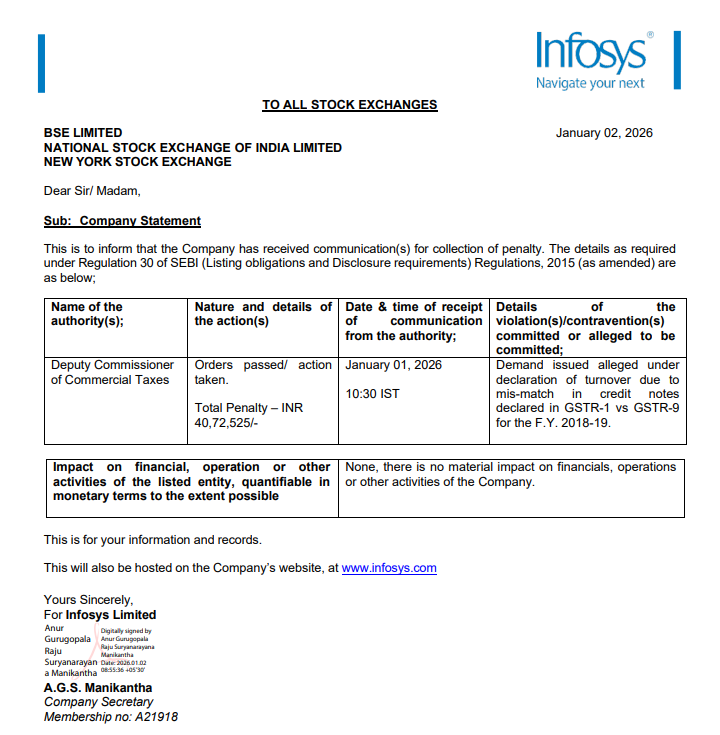

Infosys Limited, in a regulatory filing dated January 2, 2026, disclosed that it has received a communication from the Deputy Commissioner of Commercial Taxes seeking recovery of a tax penalty amounting to ₹40,72,525.

The demand was issued on January 1, 2026 at 10:30 AM IST, and pertains to an alleged mis-match in credit notes declared in GSTR-1 vis-à-vis GSTR-9, leading to a claimed under-declaration of turnover for FY 2018-19.

The disclosure was made under Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, and has been submitted to both the National Stock Exchange of India Limited (NSE) and the New York Stock Exchange (NYSE).

Infosys clarified in its filing that the penalty does not have any material impact on the company’s financial position, operations, or other business activities.

“There is no material impact on financials, operations or other activities of the Company,” Infosys stated in the exchange filing.

The company further noted that the information will also be made available on its official website as part of statutory disclosures.

The filing was signed by A.G.S. Manikantha, Company Secretary of Infosys Limited.

Key Facts at a Glance

- Company: Infosys Limited

- Penalty Amount: ₹40.72 lakh

- Authority: Deputy Commissioner of Commercial Taxes

- Issue: GSTR-1 vs GSTR-9 credit note mismatch

- Financial Year: 2018-19

- Material Impact: None (as per company)

- Disclosure Regulation: SEBI LODR Regulation 30