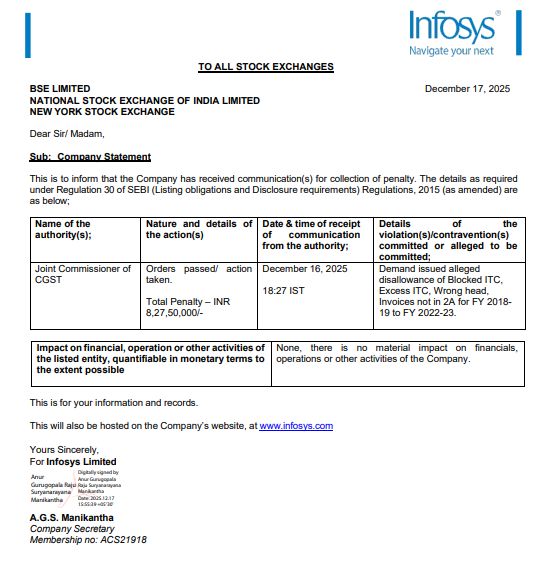

Bengaluru: IT major Infosys Limited has disclosed that it has received a penalty order of ₹8.27 lakh from the Joint Commissioner of CGST, related to alleged tax discrepancies under the Goods and Services Tax (GST) regime.

In a regulatory statement issued to all stock exchanges on December 17, 2025, Infosys said the communication was received on December 16, 2025, at 18:27 IST, in compliance with Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015.

Details of the Penalty Order

According to the disclosure:

- Authority: Joint Commissioner of CGST

- Nature of action: Order passed imposing penalty

- Penalty amount: ₹8,27,50,000

- Reason cited:

- Alleged disallowance of blocked ITC

- Issues related to wrong head classification

- Invoices not reported in GSTR-2A

- Pertaining to FY 2018–19 and FY 2022–23

Company’s Clarification

Infosys clarified that:

- The penalty does not have any material impact on the company’s financials, operations, or other business activities

- The disclosure is being made as a matter of regulatory compliance and transparency

The company also stated that the information has been uploaded on its official website.

Investor Context

Such GST penalty orders are procedural and routine in nature, especially for large enterprises with complex tax filings across multiple financial years. The quantum involved is not material in relation to Infosys’ scale of operations.